Import and export regulations

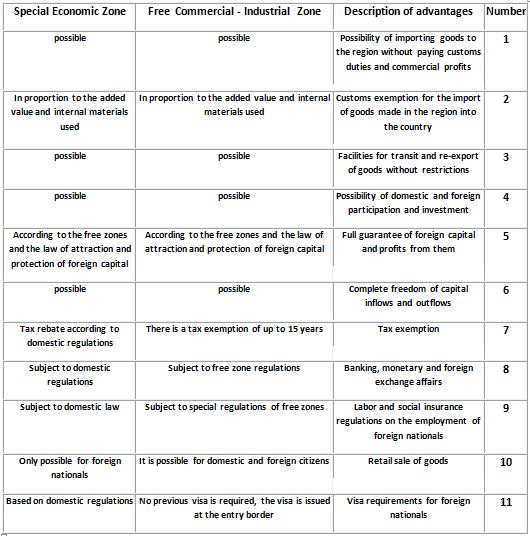

Article 8 - Trade exchanges of regions with abroad or with other special economic zones and free trade and industrial zones after registration in customs are exempt from customs duties, commercial profits and all import and export duties under any heading and are subject to restrictions and Prohibitions on import and export regulations do not apply, except for legal and sharia restrictions and prohibitions, and trade exchanges between the regions and other parts of the country, with the exception of the above-mentioned regions, are subject to export and import regulations.

Note 1- Goods that are transported from other parts of the country to regions for use and consumption are among the cases of internal transportation in the country. However, their export from the regions abroad is subject to the law of export and import regulations approved on 7/4/1372.

Note 2: Export goods whose export formalities (both banking and administrative) have been completed in full after entering the export zone are considered final.

Note 3 - Raw materials and foreign parts imported to areas that are imported into the country for processing, conversion, completion or repair are subject to temporary entry regulations and after processing, conversion or completion or repair for use in the region without preparing a declaration and The export license or at least the customs formalities will be returned to the areas and settled.

Article 9 - The entry of goods as passengers in any quantity from the region to other parts of the country is prohibited.

Article 10- Importers of goods to the regions can transfer all or part of their goods to others in exchange for a separate warehouse receipt, which will be issued by the regional organization. In this case, the holder of the separate warehouse receipt will be considered the owner of the goods.

Note: The management of each region is allowed to issue a certificate of origin for the goods leaving the region with the approval of the Iranian customs at the request of the applicant. The country's banks are obliged to accept the certificate subject to this note.

Article 11- Goods produced or processed in the region when entering other parts of the country in the amount of total value added and the value of domestic raw materials and domestic parts used in it are allowed and domestic production and will be exempt from import duties.

Note 1- The method of determining value added will be determined in the executive regulations of this law.

Note 2: Raw materials and foreign parts used in manufactured or processed goods are subject to payment of import duties, are allowed and are considered as raw materials and internal parts. The commercial profit envisaged in the import duty of the car and its spare parts is in compliance with Article (72) of the law regulating part of the government's financial regulations approved on 11/27/2001.

Article 12- The Customs of the Islamic Republic of Iran is obliged to accept the request of the owners of goods for transit of goods and direct transportation from other points of entry to the regions, and to provide the necessary facilities for this purpose.

Article 13- The deadline for stopping the goods imported to the region is at the discretion of the regional management. Criteria for stopping goods in places and areas of the region are determined and applied by the organization.

Investment and registration regulations

Article 14- The manner of accepting and entering and leaving foreign capital and the profits from it to the region and the manner and amount of foreign participation in the activities of each region will be done according to the law on encouraging and supporting foreign investment approved on 12/19/2001.

Article 15- The State Property and Deeds Registration Organization is obliged to take the following actions upon the request of the Regional Organization and in accordance with the by-laws approved by the Council of Ministers:

A- Registration of companies or representative branches of companies that intend to operate in the region, withdraw from the amount of participation of their domestic or foreign shares, as well as registration of material and intellectual property in the region.

B- Separation of real estate located in the region with the opinion of the regional organization and issuance of separate ownership documents related to the observance of current laws of the country.

Miscellaneous regulations

Article 16- Matters related to manpower employment and labor relations, insurance and social security in the region will be based on the approved and current regulations in the free trade-industrial zones.

Article 17- Any acquired rights of natural and legal persons are valid before the creation of the region and their continuation of activities will be allowed within the framework of the comprehensive plan of the region.

Article 18 - Ministries, organizations, institutions and government and government-affiliated companies in the field of legal duties, the necessary services such as electricity, water, telecommunications, fuel and other services within the limits of facilities and at the current approved rates in the same geographical area. Will provide to regions.

Article 19- The existing zones are subject to this law and the organizations in charge of special economic zones that have been established until the date of enactment of this law are obliged to comply with this law within one year (from the date of enactment of this law) in order to continue their activities.

Article 20- The boundaries of special economic zones are not part of the customs territory of the Islamic Republic of Iran and the customs is obliged to establish them at their entry and exit points in order to apply the regulations related to export and import, observing the provisions of Article 8 of this law.

Article 21 - Activities within each region, with the exception of the cases mentioned in this law, are subject to other laws and regulations of the Islamic Republic of Iran.

Article 22- The responsible government organization can transfer the innovations and lands belonging to it in the region based on the expert price.

Note: The transfer of lands subject to this article by natural or legal persons exploiting it, subject to land use, shall be subject to the submission of a certificate of completion issued by the organization of each region.

Article 23- From the date of enactment of this law, in areas where the responsible organization is governmental or affiliated with the government, all rights, powers and legal duties of the Ministry of Jihad Agriculture and Forests and Rangelands Organization in the affairs of lands and natural resources of each region shall be the responsibility of the responsible organization. Area.

Article 24 - The exercise of sovereign affairs in accordance with the relevant laws is the responsibility of the government.

Article 25- The executive by-law of this law will be approved by the Cabinet upon the proposal of the Ministries of Economic Affairs, Finance and Trade, the Management and Planning Organization of the country and the Secretariat of the Supreme Council of Free Zones.

The above law, consisting of twenty-five articles and twelve notes, was approved by the Islamic Consultative Assembly in a public session on Wednesday, June 11, 2004, and was amended on 9/5/2005 with amendments to the note of Article (1) and the annexation of one. A note to it and notes (1) and (2) of Article (3) and annexation of an article entitled Article (24) were approved by the Expediency Council.